Technical analysis (TA) is based on the startlingly simple idea that all relevant fundamental information about a tradable security is incorporated into the price. Therefore, all technical trading strategies are based on variations of price and volume. Technical analysis includes the study of trends, countertrends, moving averages, areas of support and resistance, volume patterns, and price patterns. In addition, increasingly sophisticated indicators are being developed on a regular basis.

Technical analysis can be traced back to the late nineteenth century writings of Charles Dow, founder of the Dow Jones Company. His approach came be known as the Dow Theory. It asserted that the stock market moves in certain phases with predictable patterns. John McGee and R. D. Edwards published the first of many editions of their classic book, Technical Analysis of Stock Trends in 1948 and popularized the term.

The legendary speculator Munehisa Homma was among the first of several famous technicians who used past prices to predict future price movements. Homma amassed a huge fortune in the rice market in the 1700s in Japan. His techniques evolved into what are known today as the candlestick patterns.

Alfred Cowles (1933) was probably the first to conduct an empirical study of technical analysis that was published in an academic journal. He calculated that Hamilton’s forecasts based on the Dow Theory over the period of 1904 and 1929 were successful 55% of the time.

Few researchers studied technical analysis until the 1960s, when Fama and Blume (1966) showed that common filter rules were not profitable based on daily prices of 30 individual securities in the Dow Jones Industrial Average (DJIA) from 1956 to1962. A similar conclusion was also reached by Jensen and Benington (1970) in their study of relative strength systems. These empirical findings were what perhaps prompted Fama (1970) to propose the well known efficient market hypothesis that market prices reflect all available information. According to this view – that for decades reflected mainstream academic thinking – no abnormal returns (i.e., profits greater than the overall market averages) can be attained by using historical price and other market data.

It is not surprising therefore that some academics take a strong view against technical analysis. For example, Bernard Malkiel (1981), a defender of the efficient market hypothesis, in his influential book, A Random Walk Down Wall Street, wrote, “Technical analysis is anathema to the academic world.” From his point of view, technical analysis was about as useful as divination by reading tea leaves or the entrails of goats.

In practice, however, all major brokerage firms publish technical commentary on the market and many of their advisory services are based on technical analysis. Many top traders and investors use it partially or exclusively.

Technical analysts have long asserted that their predictions work because orders are clustered. According to Martin Pring, a respected writer and teacher of TA, “A support zone represents a concentration of demand, and a resistance zone a concentration of supply.” Patterns of price and volume are considered a reflection of market psychology. Buyers and sellers remember where prices have been. This memory conditions their beliefs about when prices are either too low or too high.

Findings regarding the momentum strategies appear to be particularly robust regarding different methodological approaches, periods, and countries examined. Traders confirm this with simple maxims such as “The trend is your friend.” Contrarian or countertrend approaches are also very popular among traders based on a principle known as “return to the mean” that applies to many statistical systems. These two basic approaches may seem contradictory. However, they are known to work well together. Many traders apply a return to the mean strategy, but always in the direction of what they see as the prevailing trend.

A popular strategy that made its reputation in the early 80’s is pairs trading. In the mid-1980s, the Wall Street quant Nunzio Tartaglia, working for Morgan Stanley, assembled a team of physicists, mathematicians, and computer scientists to uncover arbitrage opportunities in the equities markets. Tartaglia’s group of former academics used sophisticated statistical methods to develop high-tech trading programs, executable through automated trading systems that took the intuition and trader’s skill out of arbitrage and replaced it with disciplined, consistent filter rules. Among other things, Tartaglia’s programs identified pairs of securities whose prices tended to move together.

They traded these pairs with success in 1987 – a year when the group reportedly made a $50 million profit for the firm. Although the Morgan Stanley group disbanded in 1989 after a couple of bad years of performance, pairs trading has since become an increasingly popular market neutral, investment strategy used by individual and institutional traders as well as hedge funds.

The basic idea of pairs trading is to take advantage of market inefficiencies. The first step is to identify two stocks that move together and trade them every time the absolute distance between the price paths is above a particular threshold value. If the stocks, after the divergence, return to the historical behavior of symmetry, then it is expected that the one with highest price is going to have a decrease in value and the one with the lowest price will have an increase. All long and short positions are taken with this logic in mind.

The profitability of technical trading strategies is a conundrum. On the one hand, technical analysis only needs public available information like asset prices. If the market is “weakly efficient,” as widely believed among financial economists, rational investors should quickly arbitrage away the profits, and therefore leave no room for technical analysis. On the other hand, if technical analysis cannot generate persistent profits, why do so many experienced traders place some weight on it in costly trading activity?

One reason that technical analysis may work as well as it does is the well documented psychological phenomena known as confirmation bias. This has been shown to play a key role in other types of decision making. Traders who acquire information and trade on that information tend to bias their interpretation of subsequent information in the direction of their original view. This produces autocorrelations and patterns of price movement that can predict future prices, such as the “head and shoulders” and “double-top” patterns. In other words, technical analysis works, insofar as it does, simply because active traders believe that it works and place their trades accordingly. Their trades then influence prices in something of a self-fulfilling manner.

Research on the efficacy of chart patterns and trading rules.

The studies that follow just below are presented to convey a general sense of the efficacy of technical analysis. I have not attempted to derive any specific trading strategies from these findings. Those will be included in the numbered sections.

Lo, Mamaysky, and Wang (2002), from the Massachusetts Institute of Technology, developed mathematical algorithms for detecting ten visual patterns widely used by technical analysts. A detailed description of each of these approaches is beyond the scope of this book. However, definitions can be obtained by clicking on the attached links (drawn from a variety of internet resources). The approaches that Lo, et al. worked with included:

They applied these algorithms to a large number of U.S. stocks from 1962 to 1996 to evaluate the effectiveness of technical analysis.

They found that over the 31-year sample period, several technical indicators did provide incremental information leading to higher stock returns than a buy and hold strategy. They found “overwhelming” statistical significance for all the indicators when tested on NASDAQ stocks. They cautioned, as I reiterate in this book, that the patterns that led to statistical significance may not necessarily lead to trading profits, because of transaction costs.

Hsu and Kuan (2005), from Columbia University and the Academia Sinica, Taipei, Taiwan, conducted a massive study of technical trading rules. They employed 39,832 different rules and tested them against the four major U.S. market indices: the NASDAQ, the Dow Jones Industrial Average (DJIA), the S&P 500 index, and the Russell 2000 index.

They looked at daily data from 1989 through 2002. They used the period through 2000 as their in-sample period for the development of hypotheses. The years 2001 and 2002 were used as the out-of-sample confirmation periods. The following table lists the basic categories of simple trading rules, totaling 18,326, that they employed.

In addition, for each of the simple rules shown above, they created “contrarian rules” looking for the exact opposite effect. That added another 18,326 rules. Finally, they arrived at a number of investor strategies, as shown in the following chart, that typically involved combinations of different simple rules.

|

Investor’s Strategies

|

|

| Learning Strategies |

1,404 |

| Vote Strategies |

888 |

| Position Changeable Strategies |

888 |

A learning strategy involves investors switching their positions by following the best performing rule within a rule class. A vote strategy, as referred to in the above chart, is based on the “voting” result of the trading rules in a rule class.The position changeable strategies differ from learning and vote strategies in that they allow for changing position sizes.

They found that significantly profitable simple rules and investor’s strategies were available for the samples from relatively “young” markets (NASDAQ Composite and Russell 2000) but not for those of more “mature” markets (DJIA and S&P 500). Their empirical results also indicated the importance of investor’s strategies in technical analysis. They found that there were more significantly profitable strategies in the investor’s strategies category than in the much larger group of simple trading rules. They also found that technical investors were capable of constructing superior strategies from simple rules. Investor’s strategies could even generate significant profits from unprofitable simple rules.

Lento and Gradojevic (2007), from Lakehead University in Ontario, Canada, attempted to determine the profitability of technical trading rules by evaluating their ability to outperform the naïve buy-and-hold trading strategy. They examined the daily closing prices for the Toronto Stock Exchange, the Dow Jones Industrial Average Index, the NASDAQ Composite Index and the Canada/U.S. spot exchange rate from May 9, 1995, to December 31, 2004. They tested the following:

After accounting for transaction costs, excess returns were generated by the moving average crossover rules and trading range breakout rules for the S&P/TSX 300 Index, NASDAQ Composite Index and the Canada/U.S. spot exchange rate. Filter rules also earned excess returns when applied on the Canada/U.S. spot exchange rate. In fact, the trading rules performed best in the foreign exchange market. The profitability of the technical trading rules was further enhanced with a combined signal approach.

Park and Irwin (2007), of the Korea Futures Association and the University of Illinois, conducted a literature survey on the profitability of technical analysis. The empirical literature was categorized into two groups, “early” and “modern” studies, according to the characteristics of testing procedures. Early studies indicated that technical trading strategies were profitable in foreign exchange markets and futures markets, but not in stock markets.

Modern studies indicated that technical trading strategies consistently generated economic profits in a variety of speculative markets at least until the early 1990s. Among a total of 95 modern studies, 56 studies found positive results regarding technical trading strategies, 20 studies obtained negative results, and 19 studies indicated mixed results. Despite the positive evidence on the profitability of technical trading strategies, Park and Irwin claimed that most empirical studies were subject to various problems in their testing procedures, e.g. data snooping, ex post selection of trading rules or search technologies, and difficulties in estimation of risk and transaction costs.

Other recent studies have failed to confirm the utility of technical analysis. Example of such disconfirmations include Dewachter and Lyrio (2006), from the Erasmus University of Rotterdam, the Netherlands; Yen and Hsu (2010), from National Cheng Kung University,Tainan, and National Chung Hsing University, Taichung, Taiwan; and Bajgrowicz and Scaillet (2012), from the Universite de Geneve, Switzerland. All of these negative findings are testimony to the difficulty of obtaining consistent alpha in the marketplace.

Kuang, Schröder, and Wang (2008) – from Goethe University, Frankfurt, Germany, and the Centre for European Economic Research, Mannheim, Germany – conducted a study with a methodology almost identical to that of Hsu and Kuan (2005) above. The difference was that they explored the application of technical chart patterns to the prices of emerging market currencies. They looked at data from January 1981 to July 2007 from ten emerging markets traded against the British Pound.

They found thousands of profitable rules for every emerging currency exchange rate that they evaluated. However, the profitability disappeared in most cases when they ran additional test to eliminate the possibility of data snooping bias. Overall they found only rare evidence that technical trading rules could overcome the efficiency of emerging FX markets.

Neely, Weller, and Ulrich (2009), from the Federal Reserve Bank of St. Louis, the University of Iowa, and Wells Fargo Home Mortgage, analyzed the stability of excess returns from technical trading rules in the foreign exchange markets. They examined daily exchange rates of ten different currencies against the U.S. dollar from April 1973 through June 2005. For those currencies that were superseded by the euro during the sample, their analysis used the levels and returns implied by the parity with the euro at monetary union. Their methodology entailed conducting true, out-of-sample tests on previously studied rules.

They discovered that the excess returns reported during the 1970s and 1980s were genuine and not just the result of data mining. However, the profit opportunities for filter and moving average rules had disappeared by the early 1990s. They also showed that these excess returns declined over time, but at a much slower speed than would have been consistent with the efficient market hypothesis.

They found that returns from less-studied or more complex rules, such as channel rules, ARIMA models, genetic programming and Markov models also seem to have declined, but had not completely disappeared.

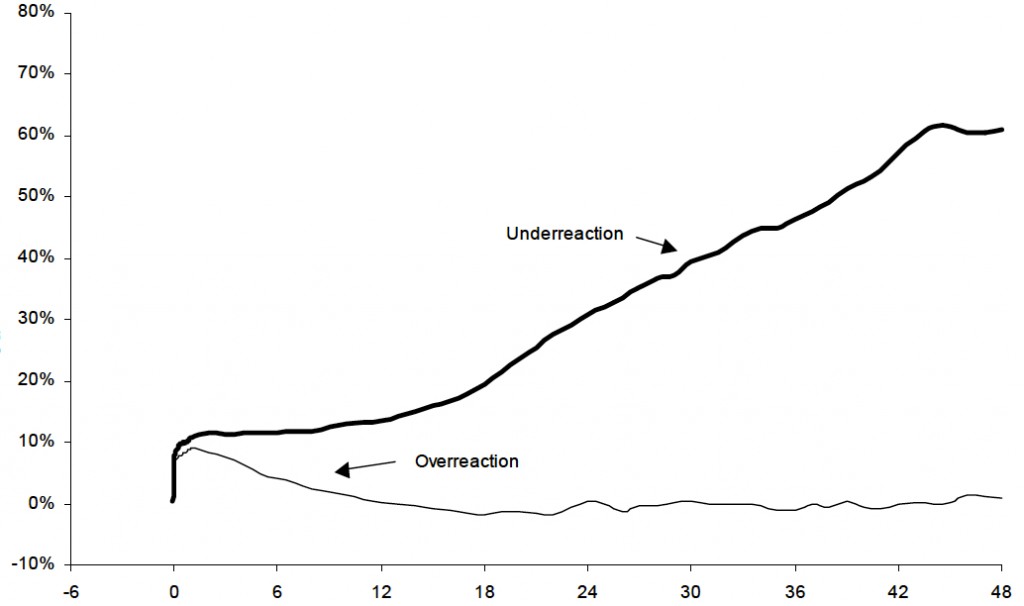

Their findings were consistent with a view of markets as adaptive systems subject to evolutionary selection pressures. This hypothesis, called the Adaptive Market Hypothesis (AMH) was put forward by Andrew Lo (2004), of the Massachusetts Institute of Technology, as an alternative to the efficient market hypothesis. The adaptive markets hypothesis views markets as ecological systems in which different groups or “species” compete for scarce resources. The system will tend to exhibit cycles in which competition depletes existing resources (trading opportunities), but new opportunities then appear.

The AMH predicts that profit opportunities will generally exist in financial markets but that learning and competition will gradually erode these opportunities as they become known. Because complexity inhibits learning, more complex strategies will persist longer than simple ones. As some strategies decline as they become less profitable, there will be a tendency for other strategies to appear in response to the changing market environment. Profitable trading opportunities will fluctuate over time. Previously successful strategies will display deteriorating performance, and at the same time new opportunities will appear.

When a market attracts more investors and traders, they may exploit the possible profitability of trading rules and eventually trade away all profitability. This is also known as “self-destruction” of profitable trading rules (Timmerman and Granger, 2004) and explains why the predictive power of technical rules weakens when the market becomes more efficient. It is for this reason that the twenty-four, scientifically based trading strategies that follow must all be viewed as provisional. When enough traders and investors employ these strategies, and further strive to enter the market ahead of other competitors, the market dynamics will change. The inefficiencies these strategies represent will dwindle; and new inefficiencies will appear.

The good news is that there are so many potentially useful strategies that many of them will never be overused. The following 24 trading strategies have withstood the scrutiny of researchers and are examples of such useful potential. They may be even more powerful when combined with each other or with strategies from other books in The Alpha Interface series.