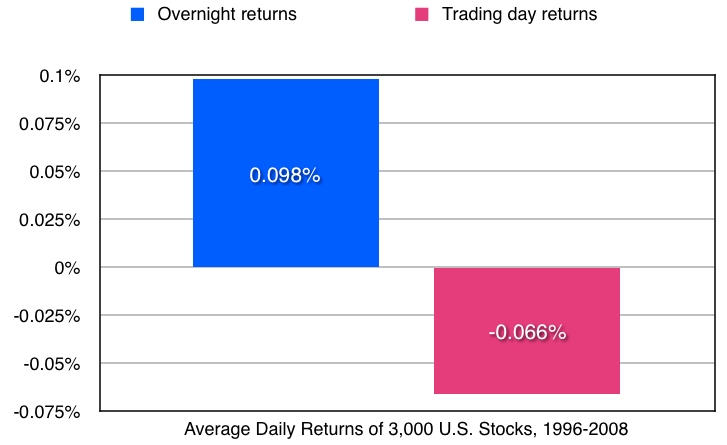

Berkman, Koch, Tuttle and Zhang (2012) – from the University of Auckland, New Zealand; the University of Kansas; the American University of Sharjah, United Arab Emirates; and Missouri State University – examined the intraday stock prices of the 3,000 largest U.S. firms from 1996 through 2008. They found a strong tendency for positive returns during the overnight period followed by reversals during the trading day. This behavior was driven initially by an opening price that was high relative to intraday prices. It was concentrated among stocks that had recently attracted the attention of retail investors (typically due to a news announcement), it was more pronounced for stocks that were difficult to value and costly to arbitrage, and it was greater during periods of high overall retail investor sentiment.

The high opening prices they found for stocks subject to high attention and low institutional ownership represented a substantial hidden cost of buying at the open. Their tests were predictive and thus indicated that postponing purchases of these stocks from the open until later in the day can avoid these hidden costs. Similarly, selling these stocks at the open, rather than later in the day, can lead to major improvements in performance. For example, a mean trading day reversal of 45 basis points (i.e., 0.45%) per day accumulates to 112.5% per annum.

They also found that this effect correlated with measure of investor sentiment. For example, mean overnight returns and trading day reversals were more than twice as large during months with high versus low sentiment. One of their sentiment measures was the Baker and Wurgler (2007) sentiment index. The other measure was based upon market-wide net buying activity by retail investors during the 1st hour of the trading day.