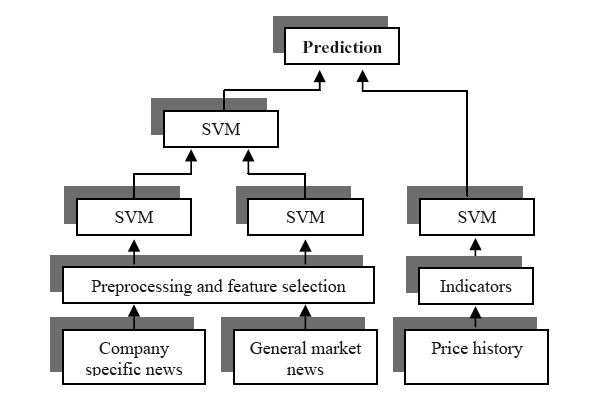

Zhai, Hsu, and Halgamuge (2007), of the University of Melbourne, Australia, have developed a unique approach for analyzing news stories in combination with market price data using a type of machine learning known as a support vector machine. The research data used in this study was the daily prices (open, high, low, close) of BHP Billiton Ltd. (BHP.AX) of Australian Stock Exchange between March 1st, 2005 and May 31st, 2006. The researchers also used news articles related to BHP and its market sector in the same period. These were published on Australian Financial Review, a major newspaper on business, finance and investment news in Australia. The architecture of their information system is shown in the diagram below:

The technical indicators that the system employed were: stochastic, momentum, rate of change, Williams %R, advance-decline oscillator, and a measure of the lowest closing price in the previous five days.

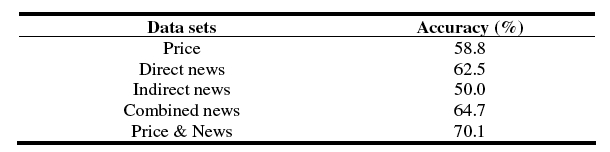

The data points in the first 12 months were used as training set, while the remaining two months served as validation set. The out-of-sample prediction accuracy they reported improved for the combined price and news approach.

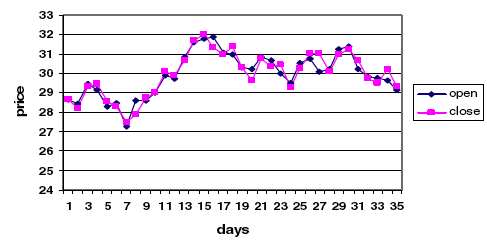

A trading strategy based on predictions showed a 5.11% profit (including transaction fee costs) during the two-month validation period. During this period, the overall price change in BHP.AX was negligible, although there was considerable volatility – as shown in the chart below.

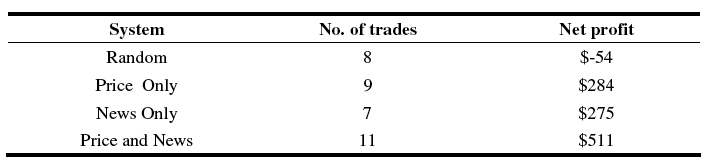

The compound net profit, using different inputs is shown in the table below:

Trading strategy: Most traders and investors will lack the resources and skill required to replicate the complete artificial intelligence strategy embodied in the Zhai, Hsu, and Halgamuge (2007) study. However, there are many other ways to track news stories that affect security prices. The research suggests that relevant news stories and technical indicators, taken in total, carry about an equal weight on prices. The advantage of combining these approaches is that they are, essentially, independent of each other. The combination of independent forecasting approaches leads to stronger statistical probabilities of success.