Sorescu and Subrahmanyam (2006), from Texas A&M University, Commerce, Texas, and the University of California, Los Angeles, analyzed the relation between analyst attributes (years of experience, reputation of the analysts’ brokerage houses) and the short- and long-term price reactions to recommendations made by the analysts. They examined data from 1993 through 2000. Considering earlier research in cognitive psychology, they hypothesized that investors would place undue emphasis on the strength of analyst recommendations. They also hypothesized that investors would place too little emphasis on the credibility of the analysts as indicated by their past performance.

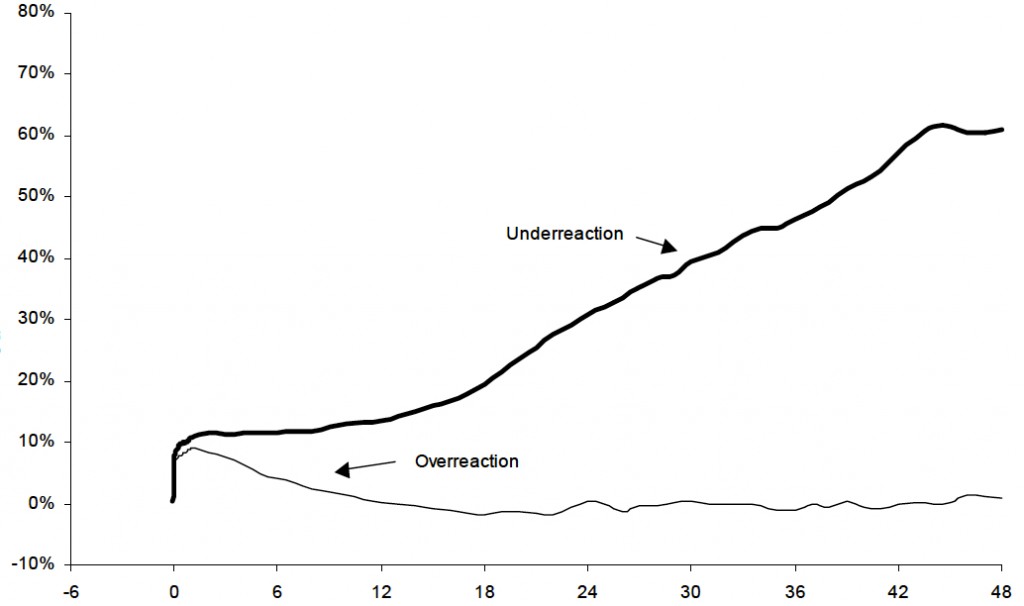

They found that in the long-term, the recommendation changes of highly experienced analysts outperformed those of low-experience ones. However, the reputation of the investment bank had a negligible impact upon the accuracy of the analysts’ forecasts. In addition, investors appeared to overreact to dramatic upgrades of low-ability analysts, and under-react to small upgrades by high-ability analysts.

This chart plots the long term, price responses to two portfolios. The heavy line shows the profitability of a portfolio based on small upgrades by high-ability analysts. The thin line shows the results of a portfolio based on dramatic upgrades by low-ability analysts. The horizontal line refers to months following the recommendations. Reprinted from Sorescu and Subrahmanyam (2006), an open-access resource.

From the chart above, it seems clear that one distinguishing feature of the high-ability analysts was the ability to recognize quality companies with the ability to sustain a long-term, growth path.

Trading strategy: You can find the most recent list of Institutional Investor All-American analysts here. Note that the study above was based upon bull market data. Even so, if you were a long-term investor, you would do well to avoid stock strongly recommended by unproven analysts. If you suspect, as some do, that we are entering a new bull market phase, pay special attention to the recommendations of the All-American analysts.