Barber, Lehavy, and Trueman (2010) – from the University of California, Davis, the University of Michigan, Ann Arbor, and the University of California, Los Angeles – examined the impact of the rating levels and changes in rating levels used by analysts. They analyzed all recommendations on the Zacks database from January 1986 through December 1995 and all real-time recommendations on the First Call database from January 1996 through the end of 2006.

Different analysts have used different rating level systems. In the most simple terms, they include strong buy, buy, hold, sell, and strong sell. However, the actual language varies a great deal. Nevertheless, for any given analyst, it is clear whether a revision is an upgrade or a downgrade. The research findings were consistent with what one would intuitively expect.

They found that the documented abnormal returns following analysts’ recommendations were derived from both the ratings levels and the ratings changes. Conditional on ratings level, upgrades earned the highest returns and downgrades the lowest. Conditional on the sign and magnitude of a ratings change, the more favorable the recommendation level, the higher was the return.

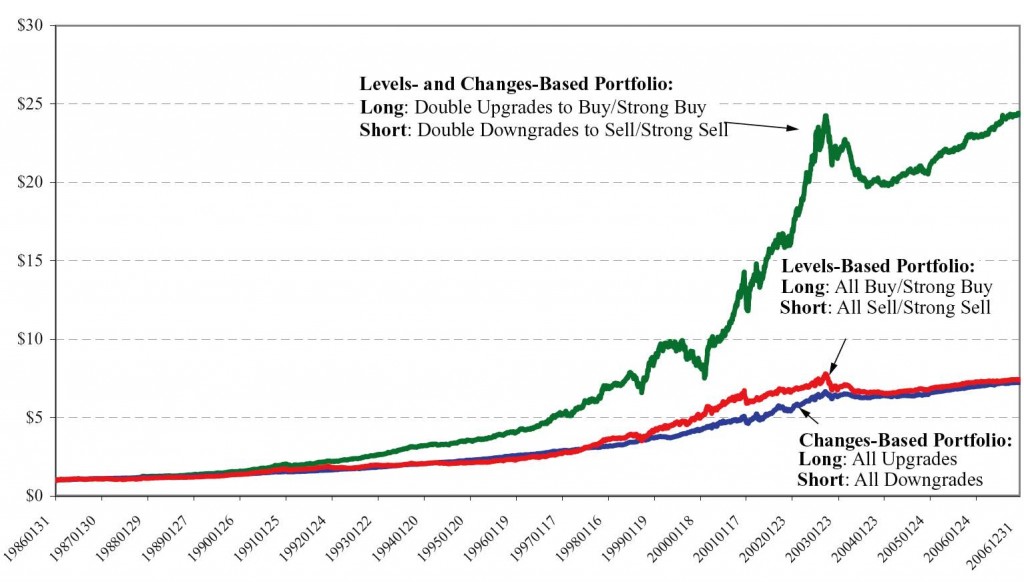

These results implied that an investment strategy based on both recommendation levels and recommendation changes had the potential to outperform one based on just one or the other. Conditioning just on recommendation levels, a strategy of buying all stocks rated buy or strong buy and shorting all those rated sell or strong sell, for example, would have earned an average daily abnormal return of 3.5 basis points during our sample period.

The stocks remained in the portfolio through the close of trading on the day that the brokerage firm removed the strong buy or sell rating (unless the recommendation removal was announced after trading hours, in which case the stock dropped out of the portfolio at the close on the next trading day).

Conditioning only on recommendation changes, a strategy of buying all stocks receiving a double upgrade and shorting all those receiving a double downgrade would have generated an average daily abnormal return of 3.8 basis points. However, conditioning on both ratings changes and levels by buying all stocks receiving a double upgrade to buy or strong buy and shorting all those receiving a double downgrade to sell or strong sell would have yielded an average daily abnormal return of 5.2 basis points. This is a greater than 4% improvement (on an annual basis) over the levels-only based strategy and a 3.5% annual improvement over that based solely on ratings changes.

They also found that rating levels and rating changes forecasted future unexpected earnings, as well as the corresponding market reactions. This result implied that the predictive power of analysts’ recommendations was not simply a product of analysts’ ability to shift investor demand. Instead, it reflected their skill at collecting valuable private information about the future financial success of the firms they covered.

Value of $1 invested in recommendation-based strategies, January 1986 through December 2006. Reprinted from Barber, Lehavy, and Trueman (2010) with permission.

Trading strategy: Buy stocks with double upgrades. Sell stocks with double downgrades. Hold those long and short positions as long as the ratings remain intact. You can enhance this strategy by limiting recommendations to those made by analysts with the best track records.