This trading strategy has been excerpted from my new, Kindle eBook,The Alpha Interface: Empirical Research on the Predictability of Financial Markets. Book One: Forty Trading Strategies Based on Scientific Findings About Analysts’ Forecasts. As the title suggests, this is one of the forty strategies I present in the eBook.

The premise of the book is that the academic literature on financial markets contains much information that is useful for traders and investors. However, for the most part, the research is in inaccessible, obscure and difficult to read journals. I have attempted to present the best trading ideas from academia in a straightforward manner. Here is one of them:

Paul J. Irvine (2003), of Emory University, Atlanta, Georgia, compared stock returns surrounding a sell-side analyst’s initiation of coverage to the returns surrounding a recommendation by an analyst who already covers the stock. He drew upon data from the second and third quarters of 1995 that included a total of 2,128 analyst reports.

He found that the market responded more positively to analysts’ initiations than to other recommendations. In a company-matched sample, the incremental price impact of an initiation was 1.02% greater than the reaction to a recommendation by an analyst who already covered the stock.

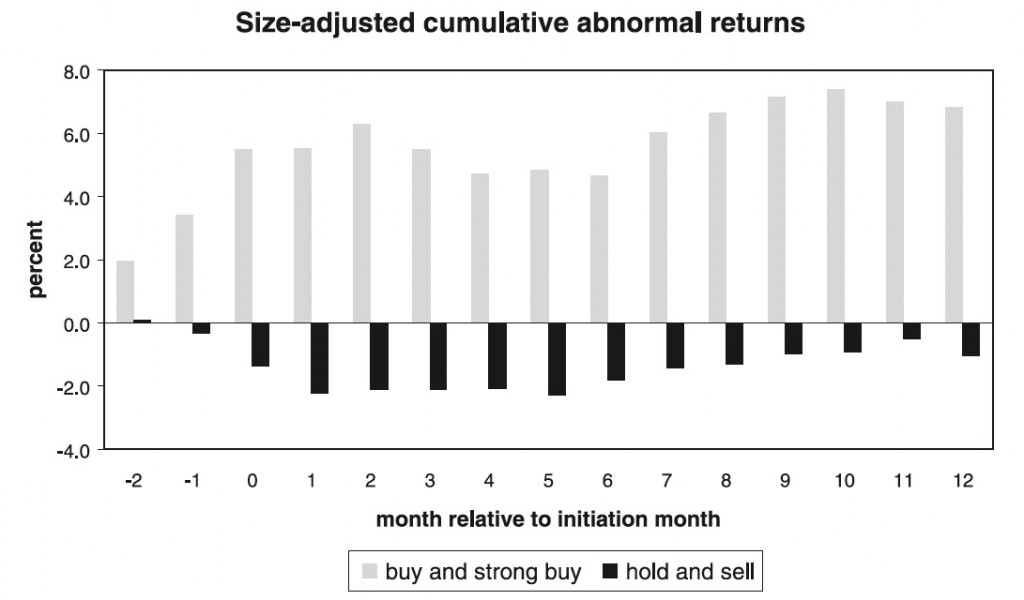

Long-term abnormal returns (i.e., alpha) around analyst initiations. Reprinted from Irvine (2003) with permission from Elsevier.

As the previous figure shows, the monthly alphas were significant in month (-2) and month (-1). This result is consistent with previous research that found analyst coverage tended to increase subsequent to positive price performance. The initiation month produced a significant positive abnormal return; but, after that month, stock prices showed no consistent pattern. Prices did not mean revert. This suggested that the price impact from an initiation was a permanent, positive event.

Initiation of analyst coverage with positive recommendations showed significant positive alpha beginning in month (-2) through the initiation month. In contract, initiation of coverage accompanied by negative recommendations was associated with insignificant abnormal returns. Positive initiations has permanent, positive effects; while negative initiations had minimal overall effect. This result was consistent with the hypothesis that the initial recommendation was related to a subsequent liquidity change.

Trading strategy: When an analyst initiates coverage of a stock with a buy recommendation, buy and hold for one month. When coverage is initiated with a hold or sell recommendation, sell and maintain the short position for one or two months.